Taxes

New Tax Collector Contact and Hours:

Beginning January, 2022, Chartiers Township has a newly elected Real Estate Tax Collector, Joseph Rozsas. Mr. Rozsas will be responsible for collecting all Chartiers Township Real Estate taxes moving forward. Please contact him with any questions or concerns.

Hours: Tuesday, Thursday, Saturday through Sept. 15, 2024 9am-12pm

Thursday and Saturday after Sept. 15, 2024 9am- 12pm

Address: 2450 W. Pike Street Ste A (Located in the rear parking lot of the fire station)

Phone: 724-344-9658

Email: realestatetax@chartierstwp.com

Payments can be made online at chartierstwp.com

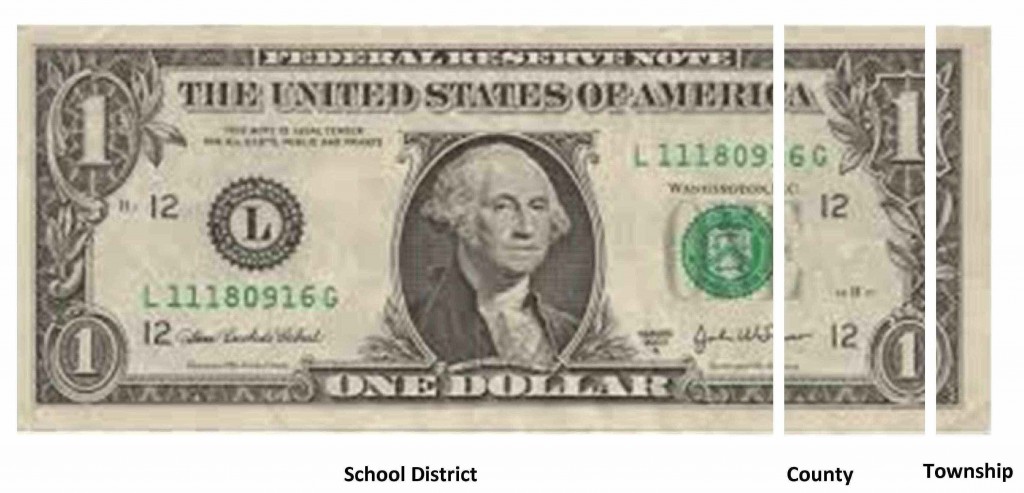

Real Estate Taxes, also known as property taxes, are levied on all residential, commercial, industrial and other non-exempt real estate by three government entities.

Tax Certification Lettter Municipality: $30.00 per parcel

Chartiers Township Millage Rate: General: 0.8632 mills; Fire Tax 0.2000

Introduction of a Fire Services Tax

While we were able to hold the line on your general purposes taxes for the 25th consecutive year, this year, the Township has enacted a Fire Services Tax in the amount 0.20 Mills to fund the Chartiers Township Volunteer Fire Department. The Board debated many sessions about implementing the Fire Tax, but ultimately deemed it necessary.

Several factors went into this decision. Townships in PA are mandated to provide fire services within their municipality. We are fortunate in Chartiers to still have an active, viable volunteer fire department and the Board felt it imperative to support them in their protection of the residents of Chartiers Township. The State General Assembly released a study, outlining the volunteer fire department crisis in the fall of 2018. Volunteer Fire Departments are declining across the state. The study noted that there over 300,000 volunteer fire fighters in PA in the 1970’s and today there are approximately 38,000 today statewide.

Further their annual fund drive to residents is also declining in donations received, while the costs of equipment and operations continue to increase. Additionally, the Volunteer Fire Department spends many hours fundraising through events like a car cruise, barbeque sale and clay shoot. However, when you consider that a volunteer fire fighter is required to dedicate over 160 hours to training to be able to fight a fire, asking them to donate even more of their time away from their families to fund raise, just so they can then volunteer to put their lives on the line to protect their community, seems unreasonable to ask of them.

The Township therefore recognized the need to provide our volunteers with a dependable revenue stream to support the needs of the Volunteer Fire Department. As the Township grows, their revenue will grow proportionally to their growing needs and since the fire tax revenues will be segregated in separate fund, they will be guaranteed for only fire services.

Additionally, supporting the volunteer fire department in this manner is economically reasonable, especially in comparison to a paid fire department. The fire tax will cost the average homeowner in Chartiers Township $34/year. That’s $2.83/ month to support your local volunteer fire department.

| Assessed Value | Annual Fire Tax | Per month |

| $ 50,000.00 | $ 10.00 | $ 0.83 |

| $ 100,000.00 | $ 20.00 | $ 1.67 |

| $ 150,000.00 | $ 30.00 | $ 2.50 |

| $ 200,000.00 | $ 40.00 | $ 3.33 |

| $ 300,000.00 | $ 60.00 | $ 5.00 |

| $ 400,000.00 | $ 80.00 | $ 6.67 |

Additionally, businesses in the Township will be providing funding to the fire department through the fire tax, to help share the burden, since it is based on real estate assessment. By comparison, this is the equivalent, of paying for just one paid fire fighter, let alone an entire paid fire department of personnel in paid fire department, if we do not support our volunteers. It is estimated that volunteer fire fighters save Pennsylvania tax payers $6 Billion per year through their volunteerism. The estimate to provide just the operational costs of a paid fire department would cost the average Chartiers Township homeowner $359/year in taxes vs. $34 for a volunteer department. That doesn't include equipment and capital costs, which are significant.

We hope residents understand that we took this decision very seriously and after weighing the options determined it to be a necessary step to help insure the future of the volunteer fire service here in Chartiers Township to keep both our volunteers and residents safe. The implementation of the fire tax allows Chartiers Township to better meet our public safety needs in both the fire department but by freeing up general fund revenues needed to fund police protection as well.

| Washington County millage | 2.43 |

| Chartiers Township | 0.8632 General; Fire Tax 0.20=1.0632 |

| Chartiers Houston School District | 13.471 |

|

All unpaid taxes are liened with Washington County Tax Claim Bureau, Court House Square, Washington PA 15301 724-228-6767

Earned Income Tax

Due quarterly. 1% of gross earnings or net profits distribution (1/2% Township ½% School)

As of tax year 2012

Keystone Collections Group

546 Wendel Road

Irwin, PA 15642

1-888-328-0558

PSD Code# 630801

For forms or to file you returns electronically, Click Here.

Certification of Residency Form Cover Letter

Local Earned Income Tax Residency Form

Local Tax Return is Due April 15

It’s that time of year again. Your 2014 local earned income tax return is due on April 15.

Did you know the quickest way to get your refund is to file online? If you live and work in Pennsylvania, you can e-file on our tax administrator’s secure website, which is available 24/7 at www.KeystoneCollects.com.

Keystone Collections Group’s e-file is the easy, fast and secure way to file your 2014 tax return. It lets you file your tax return when it is most convenient for you. You will need your W-2, your Social Security Number and any other income documents that may apply (such as a PA-UE or a Schedule C).

Please note that the forms changed this year. If you will be claiming an out-of-state tax credit or if you work in Philadelphia, you may be eligible for a local earned income tax credit up to the amount you owe to your resident municipality. The worksheet on the back of the form will help you calculate your out-of-state tax credit (attach a copy of your out-of-state filing).

If you have questions regarding local tax filing, call Keystone’s Taxpayer Helpline at 1-888-328-0565 to speak with a local, knowledgeable Taxpayer Service Agent. You can also email your questions to “Taxpayer Support” at www.KeystoneCollects.com.

Taxpayers with earned income in 2014 are required to file a tax return by Wednesday, April 15.

Local Services Tax

$52 annually and payable where employed. You are exempt from this tax if you earn less than $12,000 per year. ($47.00 Township $5.00 School). Beginning January 1, 2017, Keystone Municipal Collections will be collecting Local Services Tax. You can file online, obtain forms or information on their website at www.KeystoneCollects.com.

Delinquent Taxes

Keystone Collections Group (KeystoneCollects.com) serves as the Earned Income Tax, Local Services Tax and Delinquent Real Estate Tax Collector for Chartiers Township.

Take advantage of Keystone’s quick and easy online payment options for many taxes at KeystoneCollects.com/pay-file.

If you prefer to pay by mail, refer to Keystone’s mailing addresses.

QUESTIONS?

Visit KeystoneCollects.com for answers to your frequently asked questions.

Contact Keystone Collections Group Taxpayer Services online or at (866) 539-1100.

EARNED INCOME TAX (Current & Delinquent)

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

If you are a Wage Earner/Salaried Employee

Pennsylvania employers are required by law to withhold earned income tax from all employees’ pay. Your employer must obtain and report certain information about your residence and your PA work location and withhold the correct amount of earned income tax.

Online filing is available at efile.KeystoneCollects.com

If you are Self-Employed or Employed Outside of PA

If you are self-employed, have earnings reported on Form 1099, or work outside of PA and your employer does not withhold your earned income tax, you must report your income and pay your tax quarterly.

Report and pay quarterly estimates online at efile.KeystoneCollects.com

If you are an Employer

You are required to withhold earned income tax from your employees’ compensation. Keystone’s Business Portal is the quickest way to report EIT withholding. You can file your quarterly payroll withholding online and pay online or by mail

Local Earned Income Tax Annual Final Return Form and Instructions

Tax forms and filing instructions are sent to resident taxpayers annually. Tax forms and instructions are available online at keystonecollects.com/form/annual-final-return/

LOCAL SERVICES TAX (Current & Delinquent)

Local Services Tax (LST) is imposed where the employee works, regardless of where the employee lives. The tax is assessed during each payroll period and is withheld proportionately for the number of payroll periods within the calendar year. Pennsylvania law requires employers to withhold and report employee LST. Quarterly payroll withholding and payment is due within 30 days after the close of the calendar quarter. First quarter payment is due to the Tax Officer on or before April 30.

Business payments can be remitted online at business.KeystoneCollects.com

Individuals remitting LST should access the Local Services Tax form

REAL ESTATE TAX (Delinquent)

Annual real estate taxes are due by the due date listed on your invoice. We have partnered with Keystone Collections Group for collection of delinquent real estate taxes. Payments not received by December 31 of the year are turned over to Keystone as delinquent.

After receipt of our delinquent tax roll, Keystone mails a letter to each t taxpayer with the amount due. Please wait for that letter to pay your delinquent taxes to ensure you pay the correct amount.

Payments can be made at pay.keystonecollects.com

To obtain a receipt access pay.keystonecollects.com online and enter your invoice number. Receipts are available immediately after payment clears your bank.

Tax Certifications

To submit a real estate tax certification request, complete the Tax/Fee Certification form and follow the instructions provided on the webpage.